BLOGS

11 Aug 2025

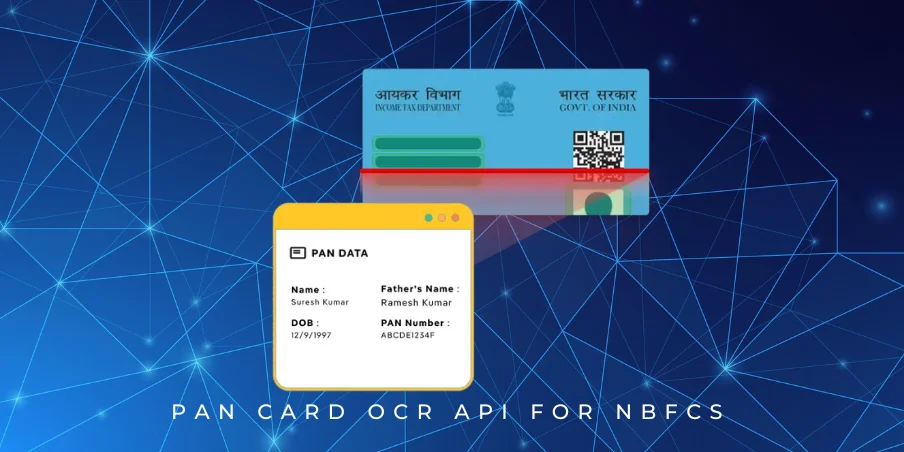

PAN Card OCR API for NBFCs: Transforming Digital Lending

PAN Card OCR API for NBFCs is the unseen force behind some of the fastest loan approvals in the industry. Picture this: a customer sitting at a café during their lunch break decides to apply for a small personal loan. They fill out a quick form, snap a photo of their PAN card, and by the time the waiter brings the bill, they’ve been approved. To the customer, it feels like magic — to the NBFC, it’s the result of advanced OCR technology working in milliseconds.

In the past, such speed was unthinkable. Loan processing meant manual verification, physical document checks, and delays stretching from hours into days. Now, with PAN Card OCR API for NBFCs, PAN details are instantly extracted, verified, and cross-checked against compliance databases. This not only accelerates onboarding but also ensures accuracy and reduces fraud risk.

And here’s the real promise: this isn’t just faster onboarding — it’s reshaping the entire lending playbook. By removing verification bottlenecks, NBFCs can approve more loans, serve more customers, and compete directly with digital-first lenders. Speed isn’t just a feature anymore; it’s a competitive advantage, and the PAN Card OCR API is making it possible.

Lending Has Changed — But KYC Hasn’t Kept Up (Until Now)

NBFC lending has come a long way — from the days of customers filling out stacks of paper forms, submitting photocopies of ID documents, and waiting for in-person verification, to today’s sleek mobile apps promising “instant” approvals. The lending interface has modernized, but for years, one thing stayed stubbornly old-school: Online KYC Verification.

Even with digital loan applications, the KYC bottleneck often slowed things down. Customers could apply in minutes, but verifying their PAN card details still required manual review, delaying disbursements and hurting the “instant” promise. In high-competition segments like microloans or Buy Now Pay Later, those extra hours could mean losing the customer entirely.

This is where OCR-based PAN verification changes the game. By integrating PAN Card OCR API for NBFCs, PAN card details are captured and verified within seconds. The system reads the card image, extracts critical data, checks formatting, and cross-verifies with compliance databases — all without human intervention. The result? The last major friction point in loan onboarding disappears, making truly instant lending a reality.

The “Superpower” of PAN Card OCR API for NBFCs

The PAN Card OCR API for NBFCs isn’t just about pulling text off a card — it’s about intelligent reading and validation. The API understands the PAN card’s structure, verifies that the number follows the official format, and instantly flags anything suspicious. It’s not passive extraction; it’s active, intelligent verification.

One of its most powerful capabilities is spotting forgeries in real time. From detecting inconsistent fonts and tampered images to identifying anomalies in the PAN number format, the OCR engine acts as an early warning system against fraud before a loan is approved.

It also excels at reading low-quality scans — something critical for NBFCs serving customers in areas where smartphone cameras or network connectivity might not be ideal. By enhancing and correcting images automatically, the OCR ensures customers aren’t forced to re-upload documents multiple times.

Finally, the API can cross-reference extracted data with backend credit checks instantly, creating a smooth pipeline from document submission to credit decision. This combination of speed, fraud detection, and seamless integration gives NBFCs a genuine superpower in the fast-paced lending market.

Micro-Moments in Lending Where OCR Makes the Difference

In modern NBFC lending, success often hinges on micro-moments — those tiny but critical points in the customer journey where speed and accuracy decide whether the user stays or drops off. The PAN Card OCR API for NBFCs is built to excel in these moments.

Loan pre-approval: The API enables instant identity confirmation, turning what used to take hours into milliseconds. Customers feel the “instant” promise of fintech is real.

Risk scoring: Valid, machine-extracted PAN data feeds directly into credit scoring models, ensuring decisions are based on verified, error-free information rather than manual entry mistakes.

Fraud prevention: OCR technology can catch manipulated or tampered documents at the upload stage, saving NBFCs from approving risky loans that would later default.

Repeat borrowing: Returning customers don’t need to re-submit PAN details; the API can validate stored information quickly, enabling faster repeat approvals and boosting customer loyalty.

By removing delays and uncertainty in these high-impact moments, PAN Card OCR becomes more than a compliance tool — it’s a competitive advantage in lending.

Case Snapshot: An NBFC’s 48-Hour to 5-Minute Transformation

A mid-sized NBFC once prided itself on “fast loans,” yet its PAN verification process still took up to 48 hours. Customers would apply, upload documents, and then… wait. By the time verification came through, many had already looked elsewhere. Loan drop-off rates were climbing, and fraud cases were slipping through undetected.

Then came the shift — they integrated the PAN Card OCR API for NBFCs. Suddenly, the verification bottleneck vanished. The API extracted and validated PAN details in under 30 seconds, seamlessly plugging into their existing loan application flow. The result? Loan approvals that once took two days were now completed in under five minutes.

The impact was immediate:

- Loan disbursals jumped by 60% thanks to faster onboarding.

- Drop-off rates during the KYC stage dropped sharply.

- Fraud cases decreased as tampered documents were flagged instantly.

For the NBFC, this wasn’t just a tech upgrade — it was a business model transformation. The promise of “instant loans” was finally real, and customers noticed.

Challenges That Make or Break OCR Integration

Even the best PAN Card OCR API for NBFCs can stumble if the integration isn’t handled carefully. The technology is powerful, but the execution is where success — or failure — happens.

Garbage images = garbage data

Blurry, low-resolution, or poorly lit images can drastically reduce OCR accuracy. Without proper pre-processing or image enhancement, even the smartest OCR will misread data.

Integrating OCR into legacy lending software

Many NBFCs still run on older core systems. Plugging a modern OCR API into these can be tricky, requiring custom connectors, API gateways, or middleware to bridge the gap.

Balancing speed with regulatory accuracy

In lending, a false positive can mean approving the wrong person, and a false negative can mean losing a good customer. The challenge is to keep processing lightning-fast while still meeting KYC and RBI compliance standards.

Ensuring data security in compliance-heavy sectors

NBFCs deal with sensitive personal information, making encryption, secure transmission, and GDPR/SOC 2/ISO-compliant handling non-negotiable. The OCR API must meet strict security benchmarks to pass audits.

The Strategic Angle: OCR as a Revenue Driver, Not Just a Cost Saver

When NBFCs look at PAN Card OCR API for NBFCs, the conversation often starts with cutting costs — fewer manual verifications, reduced manpower, and quicker processing. But the real opportunity lies in how OCR technology directly fuels revenue growth.

Faster onboarding = more loans approved in a day

Every second shaved off the KYC process means you can serve more customers in the same time frame. That translates into a higher volume of disbursals without increasing operational overhead.

Better fraud detection = fewer defaults

Intelligent OCR doesn’t just extract text — it validates it, flags anomalies, and catches forgeries before they enter your lending pipeline. This proactive fraud prevention protects margins and keeps your NPA (Non-Performing Assets) rate lower.

Happier customers = higher retention

When customers can get verified in minutes rather than days, they’re more likely to return for future loans. A seamless KYC process is a competitive advantage in a market where borrowers can switch providers with a single app download.

The Next Phase: PAN OCR + AI + Behavioural Analytics

PAN Card OCR API for NBFCs has already transformed the speed and efficiency of KYC, but the next leap will come from combining OCR with artificial intelligence and behavioural analytics.

- OCR as the first checkpoint

OCR quickly extracts and validates PAN card data, ensuring accuracy at the entry point. - AI analyzing patterns for deeper fraud detection

AI can look beyond the document — spotting subtle anomalies in application patterns, device usage, or submission behavior that may indicate fraud, even if the PAN card itself looks legitimate. - Predictive KYC

Instead of reacting after fraud happens, predictive models can flag high-risk applicants before approval, based on document quality, metadata, and behavioural signals. - Embedded lending with invisible compliance

In the future, customers won’t even notice KYC happening — PAN verification will be instant, behind the scenes, enabling “apply and approve” experiences inside any financial product.

Closing Vision: Lending Without the “Wait”

NBFCs that master PAN Card OCR API for NBFCs aren’t just improving operations — they’re resetting the standard for what customers expect from borrowing. In a world where speed often wins loyalty, instant PAN verification removes the last obstacle between intent and approval.

The vision is simple but powerful: lending that feels as quick and effortless as ordering a coffee, yet fortified with the security and compliance of a bank vault. By combining speed, accuracy, and trust, this technology doesn’t just keep up with the digital lending race — it pushes NBFCs to the front of the pack.

FAQs

1. What is PAN Card OCR API for NBFCs?

Ans: PAN Card OCR API for NBFCs is a specialized Optical Character Recognition (OCR) solution designed to read, extract, and validate data from PAN cards in milliseconds. NBFCs use it to automate KYC checks, speed up loan approvals, and reduce manual verification errors.

2. How does a PAN Card OCR API work?

Ans: A PAN Card OCR API processes an uploaded PAN card image, scans it for relevant text fields (like PAN number, name, and date of birth), validates the extracted data against formatting rules, and can even cross-check with government databases if integrated.

3. Can PAN OCR API detect forged or tampered documents?

Ans: Yes. Modern PAN OCR APIs, including the ones offered by AZAPI.ai, use AI-powered image analysis to spot inconsistencies such as mismatched fonts, altered MRZ lines, or irregular background patterns, making it harder for fraudulent documents to pass undetected.

4. Is data safe when using a PAN Card OCR API?

Ans: With AZAPI.ai, data security is a top priority. It is GDPR-compliant, SOC 2 certified, and ISO certified, ensuring that PAN data is processed following strict security protocols. For most use cases, AZAPI.ai processes data in real-time without storing it, unless explicitly required for compliance.

5. Why is PAN Card OCR important for NBFCs?

Ans: NBFCs operate in a high-speed lending environment where every second counts. PAN Card OCR API for NBFCs reduces onboarding from days to seconds, improves customer experience, lowers operational costs, and helps meet RBI’s KYC guidelines without manual delays.

6. What’s the difference between PAN Card OCR and PAN OCR API?

Ans:

- PAN Card OCR refers to the technology that reads and extracts data from the PAN card image.

- PAN OCR API is the programmable interface that lets NBFCs integrate this OCR functionality directly into their loan management or onboarding systems.

7. Does AZAPI.ai’s PAN Card OCR API work with low-quality images?

Ans: Yes. AZAPI.ai uses advanced image pre-processing to enhance blurry, low-light, or skewed images before extraction. This ensures high accuracy even in less-than-ideal customer uploads.

8. Can PAN OCR API integrate into existing NBFC software?

Ans: Absolutely. AZAPI.ai’s PAN Card OCR API is designed for quick integration with existing NBFC platforms, CRMs, or loan processing software, using REST APIs and SDKs.

9. Is PAN Card OCR API only for lending?

Ans: No. While NBFCs use it extensively for loan onboarding, PAN OCR API is also useful for mutual funds, insurance onboarding, digital wallets, and any business needing instant PAN verification.

10. How fast can AZAPI.ai’s PAN Card OCR API process a document?

Ans: In most cases, extraction and validation happen in under a second, enabling real-time lending decisions without slowing down the customer journey.